How Clark Wealth Partners can Save You Time, Stress, and Money.

Rumored Buzz on Clark Wealth Partners

Table of ContentsRumored Buzz on Clark Wealth PartnersThe Buzz on Clark Wealth PartnersThe Definitive Guide for Clark Wealth PartnersThe 25-Second Trick For Clark Wealth PartnersTop Guidelines Of Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutThe Best Strategy To Use For Clark Wealth Partners4 Easy Facts About Clark Wealth Partners Explained

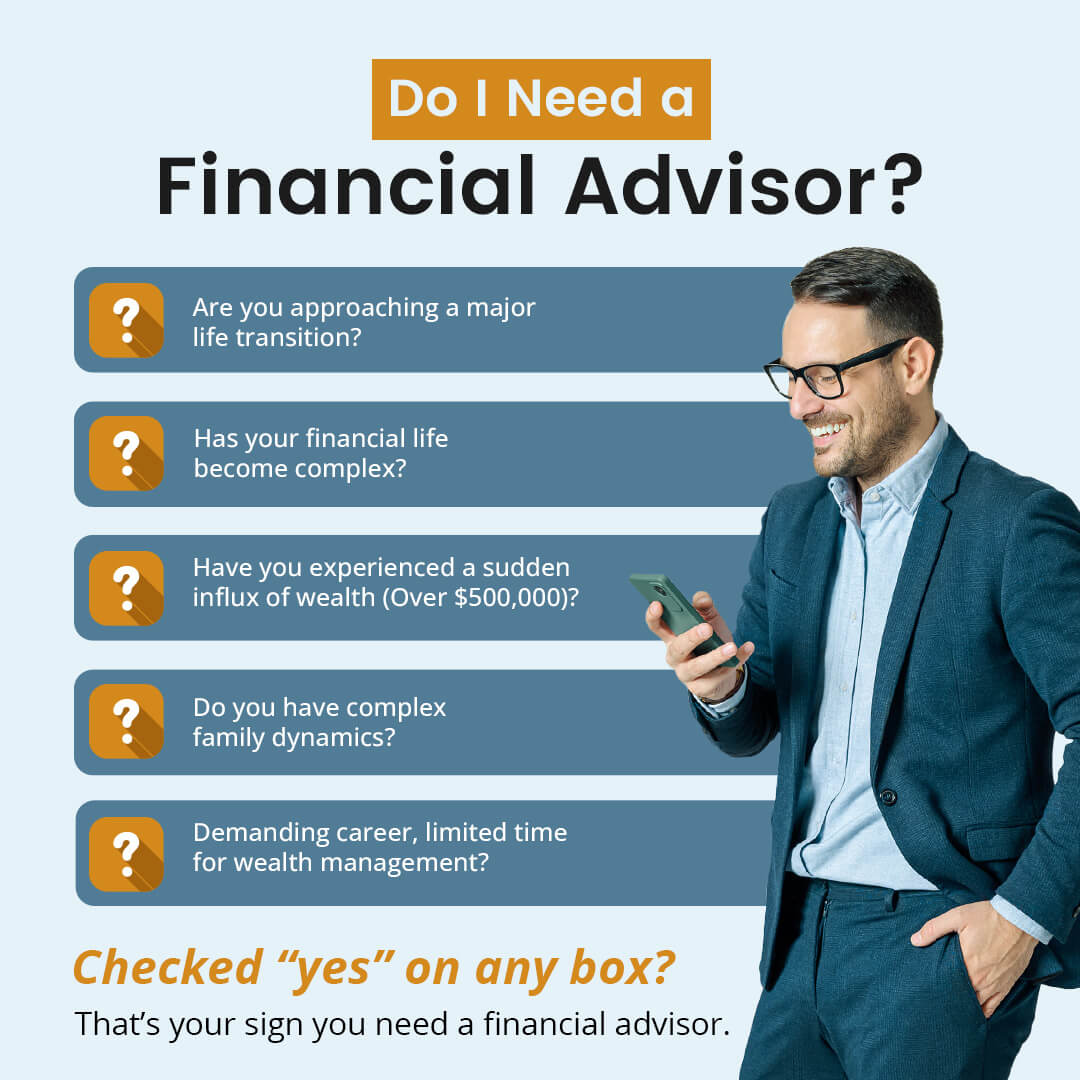

Typical factors to consider a financial consultant are: If your financial scenario has come to be a lot more complex, or you lack confidence in your money-managing abilities. Saving or navigating major life occasions like marital relationship, divorce, kids, inheritance, or work modification that may significantly impact your economic scenario. Browsing the transition from saving for retirement to protecting wide range during retired life and how to develop a solid retirement income strategy.New technology has actually led to more detailed automated financial tools, like robo-advisors. It's up to you to examine and establish the right fit - https://www.pinterest.com/pin/900368150514394496. Inevitably, a good monetary expert needs to be as conscious of your investments as they are with their very own, staying clear of extreme costs, conserving cash on tax obligations, and being as transparent as possible about your gains and losses

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Earning a commission on item referrals doesn't necessarily imply your fee-based expert works against your benefits. They might be a lot more likely to advise items and services on which they earn a commission, which might or may not be in your ideal interest. A fiduciary is legally bound to place their client's passions initially.

They may follow a freely checked "viability" criterion if they're not registered fiduciaries. This standard permits them to make suggestions for financial investments and services as long as they suit their customer's goals, danger resistance, and economic circumstance. This can equate to suggestions that will additionally earn them cash. On the other hand, fiduciary advisors are legitimately bound to act in their client's best passion as opposed to their very own.

The Best Strategy To Use For Clark Wealth Partners

ExperienceTessa reported on all points spending deep-diving into intricate financial topics, dropping light on lesser-known investment opportunities, and revealing methods readers can work the system to their benefit. As a personal financing professional in her 20s, Tessa is really familiar with the impacts time and uncertainty have on your financial investment choices.

:max_bytes(150000):strip_icc()/financialplanner.asp-FINAL-1-55c5c0b665934b9d96cfe8af04fef3a3.png)

It was a targeted advertisement, and it worked. Review more Check out much less.

Fascination About Clark Wealth Partners

There's no single path to coming to be one, with some people starting in banking or insurance policy, while others begin in accounting. A four-year degree provides a strong structure for jobs in investments, budgeting, and client services.

See This Report about Clark Wealth Partners

Typical instances consist of the FINRA Collection 7 and Series 65 exams for safety and securities, or a state-issued insurance coverage permit for selling life or medical insurance. While qualifications might not be legitimately required for all preparing roles, employers and customers typically watch them as a standard of professionalism and trust. We consider optional credentials in the next section.

The majority of financial coordinators have 1-3 years of experience and familiarity with financial products, conformity criteria, and straight client interaction. A solid instructional history is vital, yet experience shows the capacity to apply theory in real-world setups. Some programs combine both, permitting you to complete coursework while gaining supervised hours with internships and practicums.

More About Clark Wealth Partners

Many enter the area after functioning in financial, accountancy, or insurance policy, and the shift requires perseverance, networking, and often sophisticated qualifications. Very early years can bring lengthy hours, pressure to construct a customer base, and the requirement to constantly show your expertise. Still, the job provides strong lasting potential. Financial organizers take pleasure in the opportunity to function carefully with customers, overview crucial life choices, and frequently accomplish versatility in timetables or self-employment.

Riches supervisors can increase their profits with commissions, property charges, and efficiency rewards. Economic supervisors oversee a group of economic planners and advisers, setting department strategy, handling compliance, budgeting, and guiding inner procedures. They invested less time on the client-facing side of the sector. Almost all financial managers hold a bachelor's level, and many have an MBA or similar graduate level.

The 10-Minute Rule for Clark Wealth Partners

Optional certifications, such as the CFP, normally need added coursework and screening, which can prolong the timeline by a couple of years. According to the Bureau of Labor Statistics, personal economic advisors gain a mean annual annual wage of $102,140, with leading income earners earning over $239,000.

In other districts, there are laws that need them to satisfy particular demands to use the financial expert or economic coordinator titles. For economic coordinators, there are 3 common classifications: Licensed, Personal and Registered explanation Financial Organizer.

10 Simple Techniques For Clark Wealth Partners

Where to locate a financial expert will certainly depend on the kind of advice you need. These institutions have staff who may assist you recognize and buy particular types of financial investments.